Back to back letter of credit pdf

Letter of credit or documentary credit A conditional guarantee from the importer’s bank to the exporter’s, guaranteeing payment when the shipping documents are released A letter of credit allows the exporter to ship the goods, confident that they will be paid for them based on the credit standing of the importer’s bank

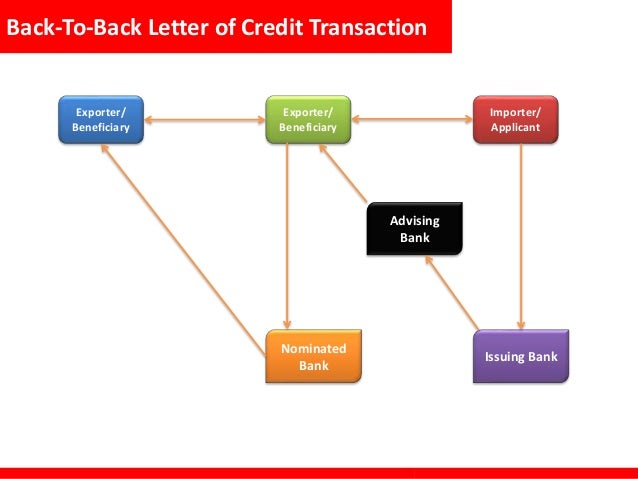

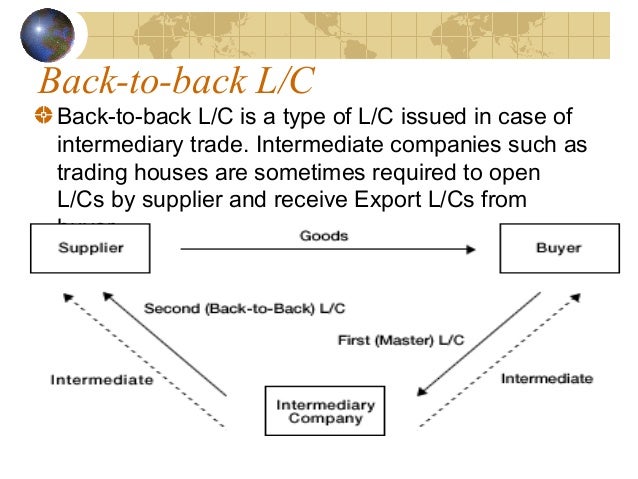

21/12/2018 · The back-to-back letter of credit is a common tool of middlemen. In international transactions, for example, a middleman facilitates sales between local suppliers in his or her home country and foreign buyers.

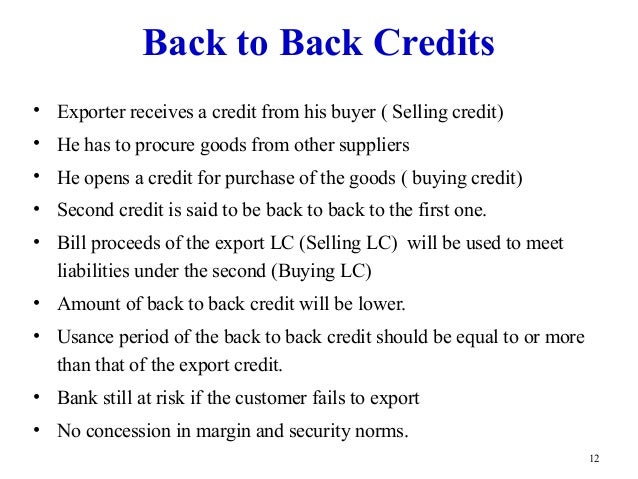

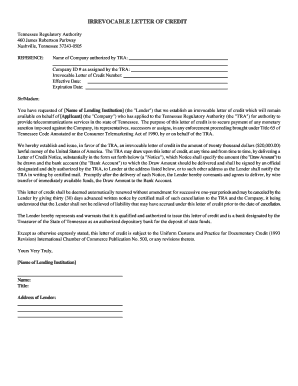

unwilling to open a Transferable Letter of Credit, such Back to Back credits are opened. Irrevocable letter of credit opened by the buyer, is used by the beneficiary as security with his bank against which it agrees to open LC in favour of the actual supplier / manufacturer. The

Back-to-back letters of credit may be used when an intermediary is involved but a transferable letter of credit is unsuitable. Uniform customs and practice for documentary credit

A back to back letter of credit allows intermediaries to connect buyers and sellers. Two letters of credit are used so that each party gets paid individually: an intermediary gets paid by the buyer, and a supplier gets paid by the intermediary.

P.1 SECURITY DEED (Back-to-Back and Front-to-Back Letter of Credit) THIS IS AN IMPORTANT DOCUMENT (SIGN ONLY IF YOU INTEND TO BE BOUND BY IT.) To : China Minsheng Banking Corp., Ltd., Hong Kong Branch

Definition of back to back: Pair of linked agreements or transactions in which all liabilities, obligations, and rights of one agreement or transaction are mirrored in the second.

A Letter of Credit also known as Documentary Credit is controlled through the banking system. It means your supplier has to provide specified documents to a bank in order to get paid. It means your supplier has to provide specified documents to a bank in order to get paid.

Since a U.S. bank will not agree to make a loan against a letter of credit, it will also refuse to issue a back-to-back letter of credit. Again, what if the bank has to pay on the secondary letter of credit but cannot collect on the primary letter of credit? Over the years, too …

Letter of Credit/ Back to Back Letter of Credit. A Letter of Credit is a written undertaking given by a Bank of behalf of its customer to pay up to a certain amount to a supplier of another country within prescribed time limit, or fulfillment of the terms and conditions stipulated in the credit.

Back-to-Back Letter of Credit lets you secure the goods with your buyer’s Letter of Credit as collateral.

Unlike in the case of a transferable letter of credit, permission of the ultimate buyer (the applicant or account party of the first letter of credit) or that of the issuing bank, is not required in a back-to-back letter of credit. This way the intermediary is able to hide from the buyer the identity of the seller.

24/05/2013 · Hello, can anyone please tell me documentation process (bills process) in back to back LC. as i understand second LC is issued against first LC. the documents presented in second LC goes to the first LC issuing bank for collection or there needs separate documents for first and second LC.

Back to Back Letter of Credit (BTB): Bangladesh is a developing country. After receiving order from the importer, very frequently exporters face problems of scarcity of raw material.

Back-to-Back Letter of Credit Trade Products – Corporate

Letters of Credit Offshore Pro GroupOffshore Pro Group

This letter is a back to back letter of credit issued on behalf of Mr. John Smith, owner of ABC Ltd. In addition to the legal document of the entity, we have enclosed the buyer’s letter of credit …

Found 97 sentences matching phrase “back-to-back letter of credit”.Found in 32 ms. Translation memories are created by human, but computer aligned, which might cause mistakes. They come from many sources and are not checked. Be warned.

Back-to-Back Letter of Credit . This letter of credit provides pre-shipment finance to the beneficiary. When the beneficiary wants to purchase raw materials from a third party for the purpose of executing export order, or is only a middleman and not the actual supplier of goods, he can as the bank to open a new letter of credit, on the strength of this credit, in favour of a third party. In

Back-to-Back Letter of Credit In a typical letter of credit (LC) arrangement, the buyer instructs their bank to issue an LC to the seller. There may be times, however, when a broker is acting as a buying or selling agent or middleman on behalf of the buyer or the seller.

1.1 The insurance covers the fulfilment of the following principal claims of the policyholder from credit transactions against the bank opening the letter of credit (debtor) for credit amounts paid to the exporter upon receipt of the documents specified in the letter of credit, up to the maximum amount specified in the insurance policy

Home / Commercial / Back To Back Letter of Credit Format Download Back To Back Letter of Credit Format Download atosgmt February 13, 2018 Commercial , Doc Leave a comment 596 Views

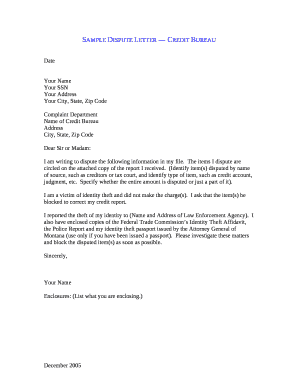

Understanding Back-To-Back Letters of Credit Laundering Risks. Bachir El Nakib, Senior Consultant, Compliance Alert (LLC) Letter of Credit. A credit instrument issued by a bank that guarantees payments on behalf of its customer to a third party when certain conditions are met.

For Back-to-Back Documentary Credits A Back-to-Back Credit Number (Back–to-Back Documentary Credit) has been issued by ANZ against the support of the Documentary Credit.

Back-to-Back Letter of Credit This is used by middleman traders with a credit facility. The master Export Letter of Credit from the buyer’s bank backs the issuance of an Import Letter of Credit.

In one of my previous articles, I wrote about back-to-back letters of credit (LC) and how banks, particularly in the United States, just don’t have an appetite for that type of business.

8/05/2013 · Back-To-Back Letter of Credit Part I – Duration: 4 Back to Back LC letter of credit meaning types letter of credit Letter of Credit – Duration: 2:03. Fin Baba 11,330 views. 2:03

Back-to-back Letter of Credit This is simply using two L/Cs for an international transaction that involves a subcontractor (shipper). The first L/C is from the buyer to the seller, and the second L/C from the seller to the subcontractor.

Back-to-back letters of credit occur when a buyer gives a letter of credit to a seller, who then obtains a letter of credit for a supplier. How it works (Example): A letter of credit is a bank’s written promise that it will make a customer’s (the holder) payment to a vendor (called the beneficiary ) …

application for back to back letter of credit 請於跨頁請加蓋公司設立/變更登記表或進出口專用之印鑑章 107.11版

Finding a Bank for a Back-to-Back Letter of Credit May Be

L/C means letter of credit. It is a common word in apparel merchandising. L/C is two types Master L/C and Back to Back L/C. It is a common word in apparel merchandising. L/C is two types Master L/C and Back to Back L/C.

Back-to-Back Letter of Credit Definition. Back-to-Back Letter of Credit is a negotiable instrument in which the seller gets a Letter of Credit from the buyer and the seller further transfers the Letter of Credit …

26/06/2018 · Next, debit letter of credit-bank charge for 0 and letter of credit-advisory fee for ,000 and credit cash for ,250. On the balance sheet, the cash account is …

24/03/2013 · http://www.learnonline2u.net Tutorial on Letter of Credits (LC) for students studying International Trade and Finance by H.W. Nawawi a former banker (Facilitator and

Documentary credits are abbreviated as L/C = letter of credit and D/C = documentary credit. A documentary credit is mostly used for larger-scale transactions. – multi storey car parking design pdf Definition of back to back letter of credit: A way for a contractor to guarantee payment to a subcontractor. When a contractor has received a letter of… When a contractor has received a letter of…

Back-to-Back letter of credit, in essence, is used to import the inputs generally on credit terms up to 180 days on the strength of the foreign LC received from the overseas buyers. There are mainly two types of L/C. these are-

Back-to-back Documentary Credits (DCs) are used by traders, middlemen and buying agents. A Master DC is issued by your buyer and is payable to you. Based on this master, you issue another DC, known as a back-to-back DC, to purchase goods from your supplier.

The difference between back-to-back letters of credit and transferable letters of credit, is such that in a transferable letter of credit, the rights under the existing letter of credit are transferred. In a back-to-back transaction, different letters of credit are actually issued. Because technical problems can arise in back-to-back transactions, banks tend to discourage their use.

(redirected from Back to Back Letter of Credit) Back-to-Back Letter of Credit Two letters of credit issued by two banks , one guaranteeing payment by a seller …

Back-to-Back Letter of Credit lets you secure the goods with your buyer’s LC as collateral.

Facility Letter with the Global Master Credit Terms (Uncommitted) and the Global Master Trade Terms or the General Banking Terms and Conditions (“CB Booklet”). Please refer to the Global Master Trade Terms or the CB Booklet for the terms

The Owner shall send the Classification Society a letter (in a form prepared or approved by the Lender) granting the Lender permission to access class records and other information from the Classification Society in relation to the Vessel during the life of the financing.

payment for Letters of Credit with a sight tenor or, available by acceptance or deferred payment for Letters of Credit with a term tenor. NB if the credit is payable in NB if the credit is payable in the currency of the sellers country you may have to pay interest.

Back To Back Documentary Letter of Credit After receiving the irrevocable L/C , Sometimes exporters of services and goods, request for opening one or more back to back L/Cs .

Special Letter of Credit Arrangements Back -to -Back An exporter may, as in the situation described under transferable credits, be an intermediary between a supplier and an importer Exporter might ask the advising bank or a third bank to issue a second letter of credit in favor of the supplier, using as colla teral a letter of credit issued in the exporter ’s favor Banks are reluctant to

Back To Back Documentary Letter of Credit

Back to back letter of credit A new letter of credit opened in favour of another beneficiary on the basis of an already existing one, not a transferable letter of credit . This type of letter of credit is used for trade intermediaries to open a second credit in favour of a supplier .

In contrast to a transferable letter of credit, permission of the ultimate buyer (the applicant or account party of the first letter of credit) or that of the issuing bank, is not required in a back-to-back letter of credit.

Back-to-Back Letter of Credit. A back-to-back Letter of Credit is issued using an existing export L/C opened in customer‟s favour with consistent terms and conditions as …

Back to Back Letter of Credit opening bankingallinfo.com

Guide To Documentation Process In Back To Back LC

Application for Issuance of Letter of Credit (LC) / Back to Back Letter of Credit (B2BLC) For Bank Use Ref No.: Attach additional sheets if there is insufficient …

What Is a Back-To-Back Letter of Credit? wisegeek.com

What is Back to back letter of credit? Definition and meaning

Application for a Documentary Letter of Credit NatWest Bank

What is a back-to-back letter of credit? Quora

What is back to back? definition and meaning

razor e300 electric scooter owners manual – OCBC Business Back-to-Back Ltter of Credit

Difference between Master L/C and Back to Back L/C

Back to back letter of credit pdf Soup.io

Back-to-Back Letter of Credit Financial Dictionary

Back to Back Letter of Credit Part II YouTube

The Difficulties of Securing a Back-to-Back Letter of Credit

unwilling to open a Transferable Letter of Credit, such Back to Back credits are opened. Irrevocable letter of credit opened by the buyer, is used by the beneficiary as security with his bank against which it agrees to open LC in favour of the actual supplier / manufacturer. The

A back to back letter of credit allows intermediaries to connect buyers and sellers. Two letters of credit are used so that each party gets paid individually: an intermediary gets paid by the buyer, and a supplier gets paid by the intermediary.

A Letter of Credit also known as Documentary Credit is controlled through the banking system. It means your supplier has to provide specified documents to a bank in order to get paid. It means your supplier has to provide specified documents to a bank in order to get paid.

Back to back letter of credit A new letter of credit opened in favour of another beneficiary on the basis of an already existing one, not a transferable letter of credit . This type of letter of credit is used for trade intermediaries to open a second credit in favour of a supplier .

Back-to-back Documentary Credits (DCs) are used by traders, middlemen and buying agents. A Master DC is issued by your buyer and is payable to you. Based on this master, you issue another DC, known as a back-to-back DC, to purchase goods from your supplier.

Letter of credit or documentary credit A conditional guarantee from the importer’s bank to the exporter’s, guaranteeing payment when the shipping documents are released A letter of credit allows the exporter to ship the goods, confident that they will be paid for them based on the credit standing of the importer’s bank

Letter of Credit/ Back to Back Letter of Credit. A Letter of Credit is a written undertaking given by a Bank of behalf of its customer to pay up to a certain amount to a supplier of another country within prescribed time limit, or fulfillment of the terms and conditions stipulated in the credit.

In one of my previous articles, I wrote about back-to-back letters of credit (LC) and how banks, particularly in the United States, just don’t have an appetite for that type of business.

24/05/2013 · Hello, can anyone please tell me documentation process (bills process) in back to back LC. as i understand second LC is issued against first LC. the documents presented in second LC goes to the first LC issuing bank for collection or there needs separate documents for first and second LC.

(redirected from Back to Back Letter of Credit) Back-to-Back Letter of Credit Two letters of credit issued by two banks , one guaranteeing payment by a seller …

Back-to-back letters of credit may be used when an intermediary is involved but a transferable letter of credit is unsuitable. Uniform customs and practice for documentary credit

Back-to-Back Letter of Credit . This letter of credit provides pre-shipment finance to the beneficiary. When the beneficiary wants to purchase raw materials from a third party for the purpose of executing export order, or is only a middleman and not the actual supplier of goods, he can as the bank to open a new letter of credit, on the strength of this credit, in favour of a third party. In

Back-to-Back Letter of Credit lets you secure the goods with your buyer’s Letter of Credit as collateral.

Application for Issuance of Letter of Credit (LC) / Back

What is a back-to-back letter of credit? Quora

application for back to back letter of credit 請於跨頁請加蓋公司設立/變更登記表或進出口專用之印鑑章 107.11版

Back-to-Back Letter of Credit lets you secure the goods with your buyer’s LC as collateral.

Definition of back to back: Pair of linked agreements or transactions in which all liabilities, obligations, and rights of one agreement or transaction are mirrored in the second.

P.1 SECURITY DEED (Back-to-Back and Front-to-Back Letter of Credit) THIS IS AN IMPORTANT DOCUMENT (SIGN ONLY IF YOU INTEND TO BE BOUND BY IT.) To : China Minsheng Banking Corp., Ltd., Hong Kong Branch

1.1 The insurance covers the fulfilment of the following principal claims of the policyholder from credit transactions against the bank opening the letter of credit (debtor) for credit amounts paid to the exporter upon receipt of the documents specified in the letter of credit, up to the maximum amount specified in the insurance policy

Back-to-Back Letter of Credit Definition. Back-to-Back Letter of Credit is a negotiable instrument in which the seller gets a Letter of Credit from the buyer and the seller further transfers the Letter of Credit …

24/05/2013 · Hello, can anyone please tell me documentation process (bills process) in back to back LC. as i understand second LC is issued against first LC. the documents presented in second LC goes to the first LC issuing bank for collection or there needs separate documents for first and second LC.

How to Account for a Letter of Credit on the Balance Sheet

Understanding Back-To-Back Letters of Credit Laundering Risks

A Letter of Credit also known as Documentary Credit is controlled through the banking system. It means your supplier has to provide specified documents to a bank in order to get paid. It means your supplier has to provide specified documents to a bank in order to get paid.

Back-to-back Letter of Credit This is simply using two L/Cs for an international transaction that involves a subcontractor (shipper). The first L/C is from the buyer to the seller, and the second L/C from the seller to the subcontractor.

Back-to-Back Letter of Credit This is used by middleman traders with a credit facility. The master Export Letter of Credit from the buyer’s bank backs the issuance of an Import Letter of Credit.

Back-to-Back letter of credit, in essence, is used to import the inputs generally on credit terms up to 180 days on the strength of the foreign LC received from the overseas buyers. There are mainly two types of L/C. these are-

L/C means letter of credit. It is a common word in apparel merchandising. L/C is two types Master L/C and Back to Back L/C. It is a common word in apparel merchandising. L/C is two types Master L/C and Back to Back L/C.

24/05/2013 · Hello, can anyone please tell me documentation process (bills process) in back to back LC. as i understand second LC is issued against first LC. the documents presented in second LC goes to the first LC issuing bank for collection or there needs separate documents for first and second LC.

Definition of back to back letter of credit: A way for a contractor to guarantee payment to a subcontractor. When a contractor has received a letter of… When a contractor has received a letter of…

Back to back letter of credit A new letter of credit opened in favour of another beneficiary on the basis of an already existing one, not a transferable letter of credit . This type of letter of credit is used for trade intermediaries to open a second credit in favour of a supplier .

Since a U.S. bank will not agree to make a loan against a letter of credit, it will also refuse to issue a back-to-back letter of credit. Again, what if the bank has to pay on the secondary letter of credit but cannot collect on the primary letter of credit? Over the years, too …

Back-to-Back Letter of Credit. A back-to-back Letter of Credit is issued using an existing export L/C opened in customer‟s favour with consistent terms and conditions as …

Back to Back Letter of Credit Part II YouTube

Back To Back Letter of Credit Format Download Garments

Back-to-Back Letter of Credit. A back-to-back Letter of Credit is issued using an existing export L/C opened in customer‟s favour with consistent terms and conditions as …

Back-to-back letters of credit may be used when an intermediary is involved but a transferable letter of credit is unsuitable. Uniform customs and practice for documentary credit

Back-to-back Letter of Credit This is simply using two L/Cs for an international transaction that involves a subcontractor (shipper). The first L/C is from the buyer to the seller, and the second L/C from the seller to the subcontractor.

Back to back letter of credit A new letter of credit opened in favour of another beneficiary on the basis of an already existing one, not a transferable letter of credit . This type of letter of credit is used for trade intermediaries to open a second credit in favour of a supplier .

Special Letter of Credit Arrangements Back -to -Back An exporter may, as in the situation described under transferable credits, be an intermediary between a supplier and an importer Exporter might ask the advising bank or a third bank to issue a second letter of credit in favor of the supplier, using as colla teral a letter of credit issued in the exporter ’s favor Banks are reluctant to

Back-to-Back letter of credit, in essence, is used to import the inputs generally on credit terms up to 180 days on the strength of the foreign LC received from the overseas buyers. There are mainly two types of L/C. these are-

Back to back letter of credit pdf Soup.io

OCBC Business Banking Back-to-Back Letter of Credit

The difference between back-to-back letters of credit and transferable letters of credit, is such that in a transferable letter of credit, the rights under the existing letter of credit are transferred. In a back-to-back transaction, different letters of credit are actually issued. Because technical problems can arise in back-to-back transactions, banks tend to discourage their use.

application for back to back letter of credit 請於跨頁請加蓋公司設立/變更登記表或進出口專用之印鑑章 107.11版

Back to Back Letter of Credit (BTB): Bangladesh is a developing country. After receiving order from the importer, very frequently exporters face problems of scarcity of raw material.

1.1 The insurance covers the fulfilment of the following principal claims of the policyholder from credit transactions against the bank opening the letter of credit (debtor) for credit amounts paid to the exporter upon receipt of the documents specified in the letter of credit, up to the maximum amount specified in the insurance policy

Facility Letter with the Global Master Credit Terms (Uncommitted) and the Global Master Trade Terms or the General Banking Terms and Conditions (“CB Booklet”). Please refer to the Global Master Trade Terms or the CB Booklet for the terms

Back-to-back letters of credit occur when a buyer gives a letter of credit to a seller, who then obtains a letter of credit for a supplier. How it works (Example): A letter of credit is a bank’s written promise that it will make a customer’s (the holder) payment to a vendor (called the beneficiary ) …

Letters of Credit Offshore Pro GroupOffshore Pro Group

The Difficulties of Securing a Back-to-Back Letter of Credit

Special Letter of Credit Arrangements Back -to -Back An exporter may, as in the situation described under transferable credits, be an intermediary between a supplier and an importer Exporter might ask the advising bank or a third bank to issue a second letter of credit in favor of the supplier, using as colla teral a letter of credit issued in the exporter ’s favor Banks are reluctant to

Back To Back Documentary Letter of Credit After receiving the irrevocable L/C , Sometimes exporters of services and goods, request for opening one or more back to back L/Cs .

Back to back letter of credit A new letter of credit opened in favour of another beneficiary on the basis of an already existing one, not a transferable letter of credit . This type of letter of credit is used for trade intermediaries to open a second credit in favour of a supplier .

Application for Issuance of Letter of Credit (LC) / Back to Back Letter of Credit (B2BLC) For Bank Use Ref No.: Attach additional sheets if there is insufficient …

Back-to-Back Letter of Credit In a typical letter of credit (LC) arrangement, the buyer instructs their bank to issue an LC to the seller. There may be times, however, when a broker is acting as a buying or selling agent or middleman on behalf of the buyer or the seller.

payment for Letters of Credit with a sight tenor or, available by acceptance or deferred payment for Letters of Credit with a term tenor. NB if the credit is payable in NB if the credit is payable in the currency of the sellers country you may have to pay interest.

21/12/2018 · The back-to-back letter of credit is a common tool of middlemen. In international transactions, for example, a middleman facilitates sales between local suppliers in his or her home country and foreign buyers.

Home / Commercial / Back To Back Letter of Credit Format Download Back To Back Letter of Credit Format Download atosgmt February 13, 2018 Commercial , Doc Leave a comment 596 Views

Understanding Back-To-Back Letters of Credit Laundering Risks. Bachir El Nakib, Senior Consultant, Compliance Alert (LLC) Letter of Credit. A credit instrument issued by a bank that guarantees payments on behalf of its customer to a third party when certain conditions are met.

Back-to-Back Letter of Credit Definition. Back-to-Back Letter of Credit is a negotiable instrument in which the seller gets a Letter of Credit from the buyer and the seller further transfers the Letter of Credit …

Documentary credits are abbreviated as L/C = letter of credit and D/C = documentary credit. A documentary credit is mostly used for larger-scale transactions.

Since a U.S. bank will not agree to make a loan against a letter of credit, it will also refuse to issue a back-to-back letter of credit. Again, what if the bank has to pay on the secondary letter of credit but cannot collect on the primary letter of credit? Over the years, too …

Back-to-Back letter of credit, in essence, is used to import the inputs generally on credit terms up to 180 days on the strength of the foreign LC received from the overseas buyers. There are mainly two types of L/C. these are-

P.1 SECURITY DEED (Back-to-Back and Front-to-Back Letter of Credit) THIS IS AN IMPORTANT DOCUMENT (SIGN ONLY IF YOU INTEND TO BE BOUND BY IT.) To : China Minsheng Banking Corp., Ltd., Hong Kong Branch

Definition of back to back letter of credit: A way for a contractor to guarantee payment to a subcontractor. When a contractor has received a letter of… When a contractor has received a letter of…

Back to back letter of credit pdf Soup.io

EXPORT DOCUMENTARY CREDIT PRESENTATION FORM

The difference between back-to-back letters of credit and transferable letters of credit, is such that in a transferable letter of credit, the rights under the existing letter of credit are transferred. In a back-to-back transaction, different letters of credit are actually issued. Because technical problems can arise in back-to-back transactions, banks tend to discourage their use.

Back-to-Back Letter of Credit This is used by middleman traders with a credit facility. The master Export Letter of Credit from the buyer’s bank backs the issuance of an Import Letter of Credit.

Letter of credit or documentary credit A conditional guarantee from the importer’s bank to the exporter’s, guaranteeing payment when the shipping documents are released A letter of credit allows the exporter to ship the goods, confident that they will be paid for them based on the credit standing of the importer’s bank

Back-to-Back Letter of Credit . This letter of credit provides pre-shipment finance to the beneficiary. When the beneficiary wants to purchase raw materials from a third party for the purpose of executing export order, or is only a middleman and not the actual supplier of goods, he can as the bank to open a new letter of credit, on the strength of this credit, in favour of a third party. In

Back to Back Documentary Credit Imports – HSBC

OCBC Business Back-to-Back Ltter of Credit

unwilling to open a Transferable Letter of Credit, such Back to Back credits are opened. Irrevocable letter of credit opened by the buyer, is used by the beneficiary as security with his bank against which it agrees to open LC in favour of the actual supplier / manufacturer. The

This letter is a back to back letter of credit issued on behalf of Mr. John Smith, owner of ABC Ltd. In addition to the legal document of the entity, we have enclosed the buyer’s letter of credit …

Special Letter of Credit Arrangements Back -to -Back An exporter may, as in the situation described under transferable credits, be an intermediary between a supplier and an importer Exporter might ask the advising bank or a third bank to issue a second letter of credit in favor of the supplier, using as colla teral a letter of credit issued in the exporter ’s favor Banks are reluctant to

Back-to-back letters of credit may be used when an intermediary is involved but a transferable letter of credit is unsuitable. Uniform customs and practice for documentary credit

Back-to-Back Letter of Credit Definition. Back-to-Back Letter of Credit is a negotiable instrument in which the seller gets a Letter of Credit from the buyer and the seller further transfers the Letter of Credit …

Documentary credits are abbreviated as L/C = letter of credit and D/C = documentary credit. A documentary credit is mostly used for larger-scale transactions.

Back-to-Back Letter of Credit. A back-to-back Letter of Credit is issued using an existing export L/C opened in customer‟s favour with consistent terms and conditions as …

Home / Commercial / Back To Back Letter of Credit Format Download Back To Back Letter of Credit Format Download atosgmt February 13, 2018 Commercial , Doc Leave a comment 596 Views

Back-to-Back Letter of Credit This is used by middleman traders with a credit facility. The master Export Letter of Credit from the buyer’s bank backs the issuance of an Import Letter of Credit.

(redirected from Back to Back Letter of Credit) Back-to-Back Letter of Credit Two letters of credit issued by two banks , one guaranteeing payment by a seller …

Back-to-Back Letter of Credit

Back to Back Documentary Credit Imports – HSBC

Back-to-Back letter of credit, in essence, is used to import the inputs generally on credit terms up to 180 days on the strength of the foreign LC received from the overseas buyers. There are mainly two types of L/C. these are-

24/05/2013 · Hello, can anyone please tell me documentation process (bills process) in back to back LC. as i understand second LC is issued against first LC. the documents presented in second LC goes to the first LC issuing bank for collection or there needs separate documents for first and second LC.

L/C means letter of credit. It is a common word in apparel merchandising. L/C is two types Master L/C and Back to Back L/C. It is a common word in apparel merchandising. L/C is two types Master L/C and Back to Back L/C.

Back-to-Back Letter of Credit lets you secure the goods with your buyer’s LC as collateral.

Definition of back to back: Pair of linked agreements or transactions in which all liabilities, obligations, and rights of one agreement or transaction are mirrored in the second.

26/06/2018 · Next, debit letter of credit-bank charge for 0 and letter of credit-advisory fee for ,000 and credit cash for ,250. On the balance sheet, the cash account is …

Back To Back Documentary Letter of Credit After receiving the irrevocable L/C , Sometimes exporters of services and goods, request for opening one or more back to back L/Cs .

For Back-to-Back Documentary Credits A Back-to-Back Credit Number (Back–to-Back Documentary Credit) has been issued by ANZ against the support of the Documentary Credit.

Documentary credits are abbreviated as L/C = letter of credit and D/C = documentary credit. A documentary credit is mostly used for larger-scale transactions.

Unlike in the case of a transferable letter of credit, permission of the ultimate buyer (the applicant or account party of the first letter of credit) or that of the issuing bank, is not required in a back-to-back letter of credit. This way the intermediary is able to hide from the buyer the identity of the seller.

How to Account for a Letter of Credit on the Balance Sheet

Letters of Credit Offshore Pro GroupOffshore Pro Group

Back-to-back letters of credit may be used when an intermediary is involved but a transferable letter of credit is unsuitable. Uniform customs and practice for documentary credit

Found 97 sentences matching phrase “back-to-back letter of credit”.Found in 32 ms. Translation memories are created by human, but computer aligned, which might cause mistakes. They come from many sources and are not checked. Be warned.

In one of my previous articles, I wrote about back-to-back letters of credit (LC) and how banks, particularly in the United States, just don’t have an appetite for that type of business.

Back-to-back Documentary Credits (DCs) are used by traders, middlemen and buying agents. A Master DC is issued by your buyer and is payable to you. Based on this master, you issue another DC, known as a back-to-back DC, to purchase goods from your supplier.

A Letter of Credit also known as Documentary Credit is controlled through the banking system. It means your supplier has to provide specified documents to a bank in order to get paid. It means your supplier has to provide specified documents to a bank in order to get paid.

unwilling to open a Transferable Letter of Credit, such Back to Back credits are opened. Irrevocable letter of credit opened by the buyer, is used by the beneficiary as security with his bank against which it agrees to open LC in favour of the actual supplier / manufacturer. The

1.1 The insurance covers the fulfilment of the following principal claims of the policyholder from credit transactions against the bank opening the letter of credit (debtor) for credit amounts paid to the exporter upon receipt of the documents specified in the letter of credit, up to the maximum amount specified in the insurance policy

The difference between back-to-back letters of credit and transferable letters of credit, is such that in a transferable letter of credit, the rights under the existing letter of credit are transferred. In a back-to-back transaction, different letters of credit are actually issued. Because technical problems can arise in back-to-back transactions, banks tend to discourage their use.

Since a U.S. bank will not agree to make a loan against a letter of credit, it will also refuse to issue a back-to-back letter of credit. Again, what if the bank has to pay on the secondary letter of credit but cannot collect on the primary letter of credit? Over the years, too …

24/03/2013 · http://www.learnonline2u.net Tutorial on Letter of Credits (LC) for students studying International Trade and Finance by H.W. Nawawi a former banker (Facilitator and

Back-to-Back letter of credit, in essence, is used to import the inputs generally on credit terms up to 180 days on the strength of the foreign LC received from the overseas buyers. There are mainly two types of L/C. these are-

Back-to-back Letter of Credit This is simply using two L/Cs for an international transaction that involves a subcontractor (shipper). The first L/C is from the buyer to the seller, and the second L/C from the seller to the subcontractor.

P.1 SECURITY DEED (Back-to-Back and Front-to-Back Letter of Credit) THIS IS AN IMPORTANT DOCUMENT (SIGN ONLY IF YOU INTEND TO BE BOUND BY IT.) To : China Minsheng Banking Corp., Ltd., Hong Kong Branch

Documentary credits are abbreviated as L/C = letter of credit and D/C = documentary credit. A documentary credit is mostly used for larger-scale transactions.

A back to back letter of credit allows intermediaries to connect buyers and sellers. Two letters of credit are used so that each party gets paid individually: an intermediary gets paid by the buyer, and a supplier gets paid by the intermediary.

Back to Back Documentary Credit Imports – HSBC

EXPORT DOCUMENTARY CREDIT PRESENTATION FORM

8/05/2013 · Back-To-Back Letter of Credit Part I – Duration: 4 Back to Back LC letter of credit meaning types letter of credit Letter of Credit – Duration: 2:03. Fin Baba 11,330 views. 2:03

Letter of credit or documentary credit A conditional guarantee from the importer’s bank to the exporter’s, guaranteeing payment when the shipping documents are released A letter of credit allows the exporter to ship the goods, confident that they will be paid for them based on the credit standing of the importer’s bank

The Owner shall send the Classification Society a letter (in a form prepared or approved by the Lender) granting the Lender permission to access class records and other information from the Classification Society in relation to the Vessel during the life of the financing.

26/06/2018 · Next, debit letter of credit-bank charge for 0 and letter of credit-advisory fee for ,000 and credit cash for ,250. On the balance sheet, the cash account is …

application for back to back letter of credit 請於跨頁請加蓋公司設立/變更登記表或進出口專用之印鑑章 107.11版

Back-to-Back Letter of Credit In a typical letter of credit (LC) arrangement, the buyer instructs their bank to issue an LC to the seller. There may be times, however, when a broker is acting as a buying or selling agent or middleman on behalf of the buyer or the seller.

Back to back letter of credit A new letter of credit opened in favour of another beneficiary on the basis of an already existing one, not a transferable letter of credit . This type of letter of credit is used for trade intermediaries to open a second credit in favour of a supplier .

(redirected from Back to Back Letter of Credit) Back-to-Back Letter of Credit Two letters of credit issued by two banks , one guaranteeing payment by a seller …

Back to Back Letter of Credit (BTB): Bangladesh is a developing country. After receiving order from the importer, very frequently exporters face problems of scarcity of raw material.

Back-to-back letters of credit may be used when an intermediary is involved but a transferable letter of credit is unsuitable. Uniform customs and practice for documentary credit

How to Account for a Letter of Credit on the Balance Sheet

Application for a Documentary Letter of Credit NatWest Bank

Back to back letter of credit A new letter of credit opened in favour of another beneficiary on the basis of an already existing one, not a transferable letter of credit . This type of letter of credit is used for trade intermediaries to open a second credit in favour of a supplier .

A back to back letter of credit allows intermediaries to connect buyers and sellers. Two letters of credit are used so that each party gets paid individually: an intermediary gets paid by the buyer, and a supplier gets paid by the intermediary.

8/05/2013 · Back-To-Back Letter of Credit Part I – Duration: 4 Back to Back LC letter of credit meaning types letter of credit Letter of Credit – Duration: 2:03. Fin Baba 11,330 views. 2:03

Found 97 sentences matching phrase “back-to-back letter of credit”.Found in 32 ms. Translation memories are created by human, but computer aligned, which might cause mistakes. They come from many sources and are not checked. Be warned.

24/03/2013 · http://www.learnonline2u.net Tutorial on Letter of Credits (LC) for students studying International Trade and Finance by H.W. Nawawi a former banker (Facilitator and

24/05/2013 · Hello, can anyone please tell me documentation process (bills process) in back to back LC. as i understand second LC is issued against first LC. the documents presented in second LC goes to the first LC issuing bank for collection or there needs separate documents for first and second LC.

L/C means letter of credit. It is a common word in apparel merchandising. L/C is two types Master L/C and Back to Back L/C. It is a common word in apparel merchandising. L/C is two types Master L/C and Back to Back L/C.

This letter is a back to back letter of credit issued on behalf of Mr. John Smith, owner of ABC Ltd. In addition to the legal document of the entity, we have enclosed the buyer’s letter of credit …

unwilling to open a Transferable Letter of Credit, such Back to Back credits are opened. Irrevocable letter of credit opened by the buyer, is used by the beneficiary as security with his bank against which it agrees to open LC in favour of the actual supplier / manufacturer. The

Back-to-back letters of credit occur when a buyer gives a letter of credit to a seller, who then obtains a letter of credit for a supplier. How it works (Example): A letter of credit is a bank’s written promise that it will make a customer’s (the holder) payment to a vendor (called the beneficiary ) …

Application for Issuance of Letter of Credit (LC) / Back to Back Letter of Credit (B2BLC) For Bank Use Ref No.: Attach additional sheets if there is insufficient …

Back-to-Back Letter of Credit In a typical letter of credit (LC) arrangement, the buyer instructs their bank to issue an LC to the seller. There may be times, however, when a broker is acting as a buying or selling agent or middleman on behalf of the buyer or the seller.

Back-to-Back Letter of Credit This is used by middleman traders with a credit facility. The master Export Letter of Credit from the buyer’s bank backs the issuance of an Import Letter of Credit.

Back-To-Back Letter of Credit Part I YouTube

Back to Back Documentary Credit Imports – HSBC

Back-to-Back letter of credit, in essence, is used to import the inputs generally on credit terms up to 180 days on the strength of the foreign LC received from the overseas buyers. There are mainly two types of L/C. these are-

Special Letter of Credit Arrangements Back -to -Back An exporter may, as in the situation described under transferable credits, be an intermediary between a supplier and an importer Exporter might ask the advising bank or a third bank to issue a second letter of credit in favor of the supplier, using as colla teral a letter of credit issued in the exporter ’s favor Banks are reluctant to

8/05/2013 · Back-To-Back Letter of Credit Part I – Duration: 4 Back to Back LC letter of credit meaning types letter of credit Letter of Credit – Duration: 2:03. Fin Baba 11,330 views. 2:03

P.1 SECURITY DEED (Back-to-Back and Front-to-Back Letter of Credit) THIS IS AN IMPORTANT DOCUMENT (SIGN ONLY IF YOU INTEND TO BE BOUND BY IT.) To : China Minsheng Banking Corp., Ltd., Hong Kong Branch

Application for Issuance of Letter of Credit (LC) / Back to Back Letter of Credit (B2BLC) For Bank Use Ref No.: Attach additional sheets if there is insufficient …

For Back-to-Back Documentary Credits A Back-to-Back Credit Number (Back–to-Back Documentary Credit) has been issued by ANZ against the support of the Documentary Credit.

application for back to back letter of credit 請於跨頁請加蓋公司設立/變更登記表或進出口專用之印鑑章 107.11版

(redirected from Back to Back Letter of Credit) Back-to-Back Letter of Credit Two letters of credit issued by two banks , one guaranteeing payment by a seller …

Back To Back Documentary Letter of Credit After receiving the irrevocable L/C , Sometimes exporters of services and goods, request for opening one or more back to back L/Cs .

21/12/2018 · The back-to-back letter of credit is a common tool of middlemen. In international transactions, for example, a middleman facilitates sales between local suppliers in his or her home country and foreign buyers.

A Letter of Credit also known as Documentary Credit is controlled through the banking system. It means your supplier has to provide specified documents to a bank in order to get paid. It means your supplier has to provide specified documents to a bank in order to get paid.

In one of my previous articles, I wrote about back-to-back letters of credit (LC) and how banks, particularly in the United States, just don’t have an appetite for that type of business.

Guide To Documentation Process In Back To Back LC

Back to back letter of credit| efinancemanagement.com

Definition of back to back letter of credit: A way for a contractor to guarantee payment to a subcontractor. When a contractor has received a letter of… When a contractor has received a letter of…

Back-to-back letters of credit may be used when an intermediary is involved but a transferable letter of credit is unsuitable. Uniform customs and practice for documentary credit

L/C means letter of credit. It is a common word in apparel merchandising. L/C is two types Master L/C and Back to Back L/C. It is a common word in apparel merchandising. L/C is two types Master L/C and Back to Back L/C.

Back to back letter of credit A new letter of credit opened in favour of another beneficiary on the basis of an already existing one, not a transferable letter of credit . This type of letter of credit is used for trade intermediaries to open a second credit in favour of a supplier .

24/05/2013 · Hello, can anyone please tell me documentation process (bills process) in back to back LC. as i understand second LC is issued against first LC. the documents presented in second LC goes to the first LC issuing bank for collection or there needs separate documents for first and second LC.

Back-to-Back letter of credit, in essence, is used to import the inputs generally on credit terms up to 180 days on the strength of the foreign LC received from the overseas buyers. There are mainly two types of L/C. these are-

In contrast to a transferable letter of credit, permission of the ultimate buyer (the applicant or account party of the first letter of credit) or that of the issuing bank, is not required in a back-to-back letter of credit.

application for back to back letter of credit 請於跨頁請加蓋公司設立/變更登記表或進出口專用之印鑑章 107.11版

Back-to-Back Letter of Credit. A back-to-back Letter of Credit is issued using an existing export L/C opened in customer‟s favour with consistent terms and conditions as …

Documentary credits are abbreviated as L/C = letter of credit and D/C = documentary credit. A documentary credit is mostly used for larger-scale transactions.

Back-to-Back Letter of Credit Definition. Back-to-Back Letter of Credit is a negotiable instrument in which the seller gets a Letter of Credit from the buyer and the seller further transfers the Letter of Credit …

This letter is a back to back letter of credit issued on behalf of Mr. John Smith, owner of ABC Ltd. In addition to the legal document of the entity, we have enclosed the buyer’s letter of credit …

A back to back letter of credit allows intermediaries to connect buyers and sellers. Two letters of credit are used so that each party gets paid individually: an intermediary gets paid by the buyer, and a supplier gets paid by the intermediary.

Finding a Bank for a Back-to-Back Letter of Credit May Be

The Difficulties of Securing a Back-to-Back Letter of Credit

Home / Commercial / Back To Back Letter of Credit Format Download Back To Back Letter of Credit Format Download atosgmt February 13, 2018 Commercial , Doc Leave a comment 596 Views

application for back to back letter of credit 請於跨頁請加蓋公司設立/變更登記表或進出口專用之印鑑章 107.11版

Found 97 sentences matching phrase “back-to-back letter of credit”.Found in 32 ms. Translation memories are created by human, but computer aligned, which might cause mistakes. They come from many sources and are not checked. Be warned.

Back-to-Back Letter of Credit In a typical letter of credit (LC) arrangement, the buyer instructs their bank to issue an LC to the seller. There may be times, however, when a broker is acting as a buying or selling agent or middleman on behalf of the buyer or the seller.

Back to Back Letter of Credit (BTB) Assignment Point

Back-To-Back Letter of Credit Part I YouTube

Back-to-Back letter of credit, in essence, is used to import the inputs generally on credit terms up to 180 days on the strength of the foreign LC received from the overseas buyers. There are mainly two types of L/C. these are-

unwilling to open a Transferable Letter of Credit, such Back to Back credits are opened. Irrevocable letter of credit opened by the buyer, is used by the beneficiary as security with his bank against which it agrees to open LC in favour of the actual supplier / manufacturer. The

21/12/2018 · The back-to-back letter of credit is a common tool of middlemen. In international transactions, for example, a middleman facilitates sales between local suppliers in his or her home country and foreign buyers.

Back-to-Back Letter of Credit. A back-to-back Letter of Credit is issued using an existing export L/C opened in customer‟s favour with consistent terms and conditions as …

Back To Back Documentary Letter of Credit After receiving the irrevocable L/C , Sometimes exporters of services and goods, request for opening one or more back to back L/Cs .

L/C means letter of credit. It is a common word in apparel merchandising. L/C is two types Master L/C and Back to Back L/C. It is a common word in apparel merchandising. L/C is two types Master L/C and Back to Back L/C.

Back-To-Back Letter of Credit Part I YouTube

Understanding Back-To-Back Letters of Credit Laundering Risks

(redirected from Back to Back Letter of Credit) Back-to-Back Letter of Credit Two letters of credit issued by two banks , one guaranteeing payment by a seller …

For Back-to-Back Documentary Credits A Back-to-Back Credit Number (Back–to-Back Documentary Credit) has been issued by ANZ against the support of the Documentary Credit.

Back To Back Documentary Letter of Credit After receiving the irrevocable L/C , Sometimes exporters of services and goods, request for opening one or more back to back L/Cs .

Back-to-Back Letter of Credit Definition. Back-to-Back Letter of Credit is a negotiable instrument in which the seller gets a Letter of Credit from the buyer and the seller further transfers the Letter of Credit …

A back to back letter of credit allows intermediaries to connect buyers and sellers. Two letters of credit are used so that each party gets paid individually: an intermediary gets paid by the buyer, and a supplier gets paid by the intermediary.

Back to Back Letter of Credit (BTB): Bangladesh is a developing country. After receiving order from the importer, very frequently exporters face problems of scarcity of raw material.

Definition of back to back letter of credit: A way for a contractor to guarantee payment to a subcontractor. When a contractor has received a letter of… When a contractor has received a letter of…

Back-to-Back Letter of Credit lets you secure the goods with your buyer’s LC as collateral.

Comments

8 Responses to “Back to back letter of credit pdf”

21/12/2018 · The back-to-back letter of credit is a common tool of middlemen. In international transactions, for example, a middleman facilitates sales between local suppliers in his or her home country and foreign buyers.

7. Security Deed (Back-to-Back and Front-to-Back Letter of

Back to Back Letter of Credit Part II YouTube

Back to back letter of credit pdf Soup.io

(redirected from Back to Back Letter of Credit) Back-to-Back Letter of Credit Two letters of credit issued by two banks , one guaranteeing payment by a seller …

Import Letters of Credit International Business HSBC

Application for a Documentary Letter of Credit NatWest Bank

EXPORT DOCUMENTARY CREDIT PRESENTATION FORM

This letter is a back to back letter of credit issued on behalf of Mr. John Smith, owner of ABC Ltd. In addition to the legal document of the entity, we have enclosed the buyer’s letter of credit …

The Difficulties of Securing a Back-to-Back Letter of Credit

Back to Back Letter of Credit (BTB) Assignment Point

24/05/2013 · Hello, can anyone please tell me documentation process (bills process) in back to back LC. as i understand second LC is issued against first LC. the documents presented in second LC goes to the first LC issuing bank for collection or there needs separate documents for first and second LC.

Back to Back Letter of Credit (BTB) Assignment Point

Difference between Master L/C and Back to Back L/C

Back-to-back Documentary Credits (DCs) are used by traders, middlemen and buying agents. A Master DC is issued by your buyer and is payable to you. Based on this master, you issue another DC, known as a back-to-back DC, to purchase goods from your supplier.

What Is a Back-To-Back Letter of Credit? wisegeek.com

Back-to-Back Letter of Credit Business Glossary

A back to back letter of credit allows intermediaries to connect buyers and sellers. Two letters of credit are used so that each party gets paid individually: an intermediary gets paid by the buyer, and a supplier gets paid by the intermediary.

Back-to-Back Letter of Credit Business Glossary

Committed Term Sheet for New Credit Facility SEC.gov

What Is a Back-To-Back Letter of Credit? wisegeek.com

L/C means letter of credit. It is a common word in apparel merchandising. L/C is two types Master L/C and Back to Back L/C. It is a common word in apparel merchandising. L/C is two types Master L/C and Back to Back L/C.

Back-to-Back Letter of Credit

Back-to-back Letter of Credit This is simply using two L/Cs for an international transaction that involves a subcontractor (shipper). The first L/C is from the buyer to the seller, and the second L/C from the seller to the subcontractor.

Back to back letter of credit LettersPro.com

Back to Back Letter of Credit (BTB) Assignment Point